Calculating mining profitability is a necessary step before launching any farm, regardless of its scale. Many beginners, when buying their first ASIC, and even experienced administrators of large data centres, first ask one simple question: how much does the equipment actually bring in every day and how long will it take to pay for itself? The answer depends on dozens of factors: the cost of electricity in your region, the efficiency of a particular miner model, changes in the BTC exchange rate, and even the policy of the selected pool. To avoid manual calculations and errors, use the profitability calculator from Vnish. This tool allows you to estimate profitability in a matter of seconds by changing just a few key parameters, namely hashrate, electricity consumption and tariff. This allows users to test different scenarios, see how rising electricity prices or increasing network complexity will affect profits, and make more informed investment decisions.

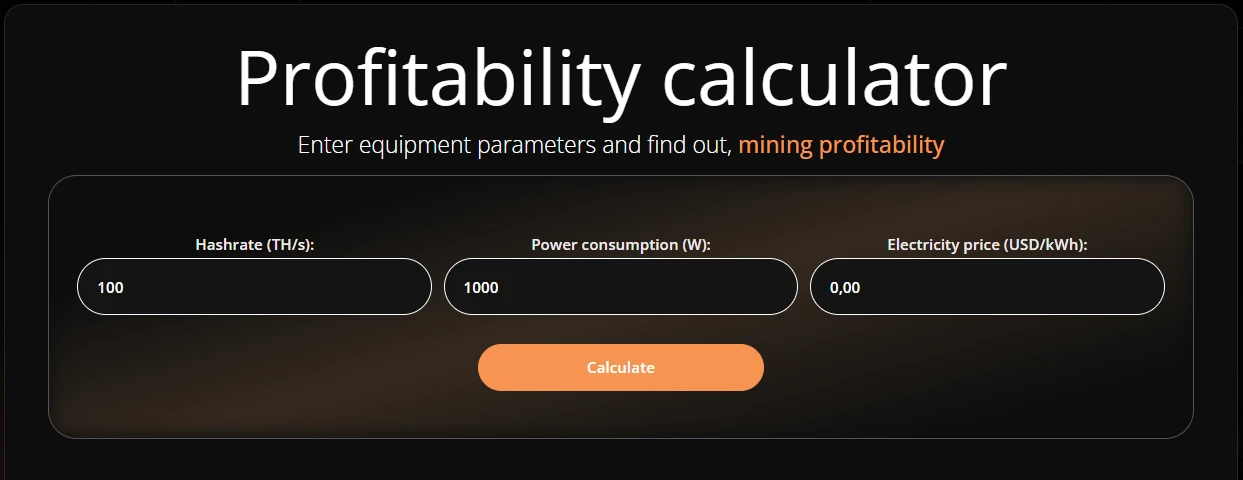

Profitability calculator from Vnish: enter the hashrate, energy consumption and tariff to calculate the profitability of mining.

Variables that matter (hashrate, W/TH, tariff, fees)

Hash rate is the main indicator of ASIC power, reflecting the number of calculations performed per second. It is measured in terahashes per second (TH/s). The higher the hash rate, the more chances your equipment has to confirm a block and receive a reward. In reality, this has a direct proportional effect on profit: for example, an Antminer S21 Pro with 234 TH/s can generate twice as much daily income as an Antminer S19j Pro with 110 TH/s, all other conditions being equal. But keep in mind: a high hash rate does not always mean optimal profitability if energy consumption increases at the same time.

In addition, the hash rate can be increased with custom firmware, which optimises chip performance and reduces the number of HW errors. You can download the latest firmware versions for various Antminer models directly from the vnish.pro website.

Power consumption directly affects the calculation of profitability. Electricity costs often account for 50-70% of a farm’s total operating costs.

- High consumption = lower net profit.

- Energy-efficient models reduce the cost of mining, especially with expensive tariffs.

- Additional cooling costs should be taken into account, as air conditioners, fans and water circulation systems also consume energy.

- Power supply units (PSUs) have their own efficiency rating: if it is 90%, then you lose 10% of the energy.

Example: An ASIC at 100 TH/s with an efficiency of 30 W/TH consumes 3000 W. If a similar miner operates at 40 W/TH, that’s 4000 W, and the difference of 1000 W per day at a rate of $0.07/kWh will cost more than $2. On a farm with 100 machines, this difference amounts to £200 per day.

The electricity tariff directly determines the profitability of the project. Even a difference of £0.01/kWh can lead to fluctuations in profitability of tens of percent over the course of a year. For example, with a consumption of 3000 W, such a difference will cost the miner about £0.72 per day, which is over £260 per year from one machine.

In addition to electricity, pool fees, which are usually 1–3%, must be taken into account. The reward model is also important:

- FPPS (Full Pay Per Share) — stable payments, including a share of transaction fees.

- PPS+ (Pay Per Share Plus) — a popular model with a balance of stability and profit.

- PPLNS (Pay Per Last N Shares) — payments depend on the actual number of blocks found, which makes profitability less predictable.

You can learn how to register with a pool and configure your equipment correctly from our guide.

Sensitivity analysis

Sensitivity analysis is a technique that allows you to understand how a change in one parameter affects the final financial result in mining. This is critically important for miners, as most changes are beyond their control: the Bitcoin exchange rate fluctuates daily, network complexity is reviewed every two weeks, and electricity tariffs depend on local markets and agreements with suppliers. Therefore, correctly calculating “what if…” scenarios helps to plan payback and assess risks.

- Change in BTC price

If the value of Bitcoin falls by 10%, income in dollars also decreases by approximately 10%, even if all other parameters remain unchanged. For example, at a rate of $120,000 and a daily income of $50 per 1 ASIC, a drop in price to $108,000 will reduce profits to ~$45. In the case of large farms, the difference can be thousands of dollars per day.

- Network difficulty

The Bitcoin code automatically adjusts the difficulty approximately every 2016 blocks (~2 weeks). If more equipment connects to the network, mining becomes more difficult and the reward per terahash decreases. This means that even without a drop in the BTC exchange rate, your ASIC will earn less. During peak periods, when large players add hundreds of thousands of TH/s, the hash price can drop by 10-20% in just a few days.

- Electricity tariff

This parameter is something that miners can actually influence. A reduction in the tariff from $0.08 to $0.04/kWh can double profitability even under the same network conditions. For example: Antminer S21 Pro with a consumption of 3500 W per day consumes ~84 kWh. At a tariff of $0.08, this is $6.72/day, and at $0.04, only $3.36. The difference of $3.36 per day for a farm with 100 miners gives an additional $10,000+ in net profit per month.

- Pool fees and reward model

Even a small difference in commission (e.g., 1% vs. 3%) reduces profitability in the long run. In addition, using FPPS or PPS+ provides more predictable results compared to PPLNS, which is especially important for large investors.

Thus, sensitivity analysis allows you not only to anticipate risks, but also to make strategic decisions. Miners can calculate scenarios in advance: “What will happen if BTC falls by 20%?”, “How will profitability change after the difficulty increase?”, “Is it worth moving equipment to a region with cheaper electricity?” and plan the development of the farm based on this.

ROI & payback

Once the cost of the equipment is known, the return on investment (ROI) can be calculated. This indicator answers the key question for every miner: how many days or months will it take for the ASIC to recoup the money spent on it and start generating net profit?

The formula for calculation is

ROI = (net profit × number of days) / initial investment

- Net profit = mining income – electricity costs – pool fees.

- Initial investment = cost of ASIC + shipping + customs duties + additional expenses (power supply, cooling).

In mining, ROI is not fixed — it constantly changes. It is influenced by:

- BTC exchange rate fluctuations;

- increased network complexity;

- your actual electricity rate;

- equipment operating mode (e.g., using custom firmware to save 5–10% energy).

Experienced users advise calculating ROI not only in days, but also in percentages. For example, ROI = 150% in 2 years means that during this time you will not only recoup your investment, but also receive an additional half of the invested amount as profit. This helps you plan reinvestments in new ASIC models or farm expansion.

Walkthrough of a calculator

To quickly assess the real profitability of the equipment, it is enough to follow a few simple steps in the calculator, but for a more accurate calculation, it is worth considering all the nuances that are described in detail in this article.

- Enter the hashrate of your equipment.

- Specify the power consumption in watts.

- Add the tariff in USD/kWh.

- Click Calculate and get the daily profit calculation.

Table with examples of popular Antminer models: hashrate, power consumption and daily profit.

Common estimation mistakes

Even with a profitability calculator, users often make the same mistakes that lead to incorrect predictions. Here are the most common ones:

- Ignoring pool fees

If a pool takes a 2–3% commission, this directly reduces your income. For example, with a daily income of $50, a 2% difference amounts to $1.50 per day, or over $540 per year.

- Underestimating cooling costs

ASICs do not operate in a vacuum. If air conditioners or additional fans are used, their energy consumption must be taken into account. In large farms, these costs can reach 10–15% of the main consumption.

- Using outdated network difficulty metrics

Network difficulty is reviewed every ~2 weeks. If you use old data, your calculations will be incorrect. Even a 5-7% increase in difficulty can eat up several percent of your expected profit.

- Focusing only on the BTC rate without taking into account the hash price

The price of Bitcoin is important, but it does not reflect all factors. For example, the exchange rate may rise, but if the complexity increases and transaction fees fall at the same time, the profit in dollars will not grow proportionally. Hash price is a more accurate indicator that takes into account a set of parameters.

The table shows the most common mistakes in mining forecasts and ways to avoid them in order to obtain realistic results when using a profitability calculator.

| Mistake | How it manifests | Consequences | How to avoid |

| Ignoring pool fees | Calculations are based on “net” income without deductions | Minus 1–3% of actual profit | Always take into account the payment model and pool commission |

| Underestimating cooling costs | Only ASIC consumption is indicated in the calculations | Underestimated cost forecast by 10–15% | Add air conditioner/fan consumption to the calculator |

| Use of outdated complexity data | Old figures from the calculator are used | Overestimated profit forecast | Update data every 2 weeks |

| Focus only on the BTC exchange rate | All calculations are made only in dollars | Loss of accuracy when network parameters change | Use the hashprice index as a baseline |

Conclusions

Calculating ASIC profitability is a necessary mathematical task that requires the right tool. Using the Vnish calculator, you can quickly estimate your income, find the best scenarios, and avoid common mistakes.

Leave a Reply