Valuing intangible assets has become vital for financial analysis, especially as modern businesses increasingly depend on non-physical assets like brands, patents, and intellectual property. Understanding the top methods—cost, market, and income approaches—unlocks deeper insights into an asset’s worth. With this guide, discover how these approaches bring clarity to assets that aren’t always easy to quantify yet hold immense value. Want a fresh perspective on valuing intangible assets? Be a wise investor and visit nerdynator.com/ if you want to learn how pro investors make solid decisions.

The Cost Approach: Measuring Intangible Assets by Recreating Their Value

The cost approach is often seen as a straightforward method, particularly when an organization can easily estimate how much it would cost to create a similar intangible asset from scratch.

Imagine, for example, a software company wanting to value its proprietary software. This approach would calculate the total expense to develop that software again, including labor, materials, and other direct costs.

This method can be especially useful for assets like patents, custom software, or even training programs. One of the benefits of the cost approach is its simplicity – it’s a practical, down-to-earth way to measure an asset based on tangible costs.

However, there’s a catch: this approach doesn’t account for an asset’s potential to generate future income. For a brand name that brings in millions through customer loyalty, the cost approach might not show the whole picture, as it doesn’t factor in the intangible value of brand reputation.

But the cost approach can still be beneficial when dealing with specific scenarios, such as research & development (R&D) investments. For instance, in tech startups, where innovation costs are high and outputs unpredictable, the cost approach can offer a foundational benchmark.

This approach might be less suitable for assets whose value depends more on perception than production, like trademarks or brand reputation, which tend to hold value beyond their creation costs.

One tip for financial analysis: This method can work well as a starting point, but combining it with other approaches can give a fuller view, especially for assets with significant revenue-generating potential.

The Market Approach: Leveraging Comparable Transactions for Fair Value Assessment

The market approach is often favored when there’s a clear market for similar assets. Picture it this way: if a company wants to value its brand name, looking at recent sales of similar brands in the industry can provide a reasonable benchmark.

The market approach uses data from similar transactions to estimate an asset’s fair value. This method is particularly relevant for assets with established markets, like trademarks, patents, or even domain names.

One major benefit of the market approach is its reliance on real data. It’s like using property prices in a neighborhood to determine a house’s value. When there’s a robust market with comparable assets, this approach can offer valuable insights.

But there’s a challenge here: finding true “comparables” isn’t always easy. For assets unique to a brand or company, it may be tough to find recent, similar transactions for an accurate comparison.

An example here would be a company with a popular app looking to value its software patent. If a similar app patent recently sold for a high price, that transaction could serve as a benchmark. But if it’s a niche product, the market approach may fall short since no identical transactions exist.

For financial analysts, the market approach is a powerful tool when data is available. However, consider using it in tandem with other methods to balance out any limitations. After all, an asset’s market value doesn’t always capture its potential earnings.

The Income Approach: Projecting Future Benefits to Quantify Intangible Worth

The income approach, unlike other methods, dives into an asset’s potential future income. It’s widely used for assets expected to generate significant returns, like patents or exclusive distribution rights. Think of it this way: if a company owns a patent for a cutting-edge technology, the income approach calculates the value based on projected earnings that patent could bring in over time.

To make these projections, the income approach often uses a discounted cash flow (DCF) analysis, which estimates future cash flows and then “discounts” them to determine their present value.

The beauty of this approach is its focus on future potential rather than past costs or comparable market data. For assets with clear revenue streams, like licensing agreements, this approach provides a realistic view of their contribution to the company’s bottom line.

However, there’s a caveat: projecting future income accurately can be challenging. Market conditions, competition, and consumer preferences can all impact future revenues, making accurate projections tricky.

Take, for instance, a patent in the pharmaceutical industry. While the patent may hold immense value due to projected future drug sales, shifts in regulations or competing drugs could impact those earnings.

Conclusion

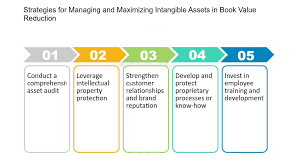

Choosing the right approach for valuing intangible assets can be the difference between clear financial insight and missed opportunities. Whether it’s the tangible costs, market comparisons, or future income potential, each method offers a unique lens on asset valuation. These strategies ensure businesses capture the true worth of their intangibles, ultimately enhancing decision-making and financial strength.

Leave a Reply