Introduction

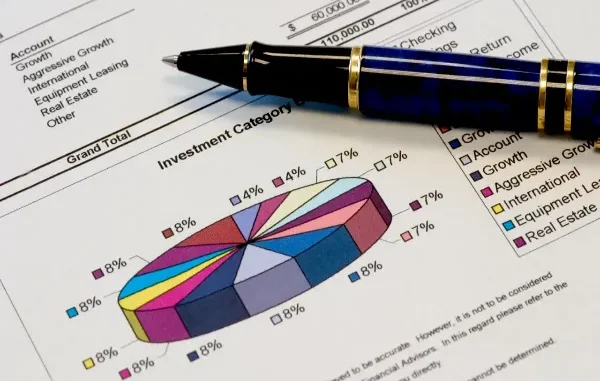

Diversification is a strategy that involves spreading your investments across different asset classes, industries, and geographical regions to reduce risk and enhance long-term growth potential. This approach is based on the idea that different investments react differently to market conditions, so having a mix of assets can help smooth out volatility and improve overall portfolio performance. Visit immediatenextgen.com to explore how you can gain and enhance your understanding of diversification and other effective investment strategies.

Reduced Risk

One of the primary benefits of diversification is risk reduction. By investing in a variety of assets, you can reduce the impact of any single investment performing poorly. For example, if you only invest in one company and that company’s stock price falls, you could lose a significant portion of your investment. However, if you spread your investments across multiple companies and industries, the impact of any one investment’s poor performance is minimized.

Diversification can also protect against specific risks associated with certain industries or asset classes. For instance, investing solely in technology stocks exposes you to the risk of a downturn in the tech sector. By diversifying your portfolio to include other sectors like healthcare, finance, and consumer goods, you can reduce your exposure to sector-specific risks.

Enhanced Portfolio Performance

In addition to risk reduction, diversification can also enhance portfolio performance. A well-diversified portfolio can capture gains from different sectors and asset classes, even if some investments are underperforming. For example, while stocks may be experiencing a downturn, bonds or real estate investments may be performing well, balancing out the overall performance of the portfolio.

Studies have shown that diversified portfolios tend to outperform non-diversified portfolios over the long term. By spreading your investments across different assets, you increase the likelihood of capturing the returns of the overall market, rather than relying on the performance of a single asset or sector.

Protection Against Market Volatility

Diversification can also protect your portfolio against market volatility. Market fluctuations are a natural part of investing, but a diversified portfolio can help mitigate the impact of these fluctuations on your overall wealth. When one asset class is experiencing volatility, others may be more stable, helping to offset potential losses.

During periods of market downturns, a diversified portfolio can be more resilient than a concentrated one. While some investments may experience losses, others may hold their value or even appreciate it, helping to cushion the overall impact on your portfolio.

Opportunity for Growth

Another benefit of diversification is the opportunity for growth. By investing in different asset classes, you can take advantage of growth opportunities in various sectors and industries. For example, while one sector may be experiencing slow growth, another may be booming, providing an opportunity for your portfolio to grow.

Diversification also allows you to capture emerging market trends. By investing in a variety of assets, you increase the likelihood of having exposure to sectors or industries that are poised for growth in the future. This can help boost your portfolio’s overall performance and long-term growth potential.

Long-Term Wealth Accumulation

Ultimately, the goal of diversification is long-term wealth accumulation. By spreading your investments across different assets, you can achieve a more stable and consistent growth trajectory. This can help you achieve your financial goals over the long term, whether it’s saving for retirement, buying a home, or funding a child’s education.

A well-diversified portfolio can also provide peace of mind, knowing that your investments are protected against certain risks and that you have a better chance of achieving your financial goals. While diversification does not guarantee against losses, it is a fundamental strategy for building wealth over the long term.

Conclusion

In conclusion, diversification is a key strategy for long-term investment growth. By spreading your investments across different asset classes, industries, and geographical regions, you can reduce risk, enhance portfolio performance, protect against market volatility, and take advantage of growth opportunities. Whether you’re a seasoned investor or just starting, diversification is an essential strategy for building wealth and achieving your financial goals.

Leave a Reply